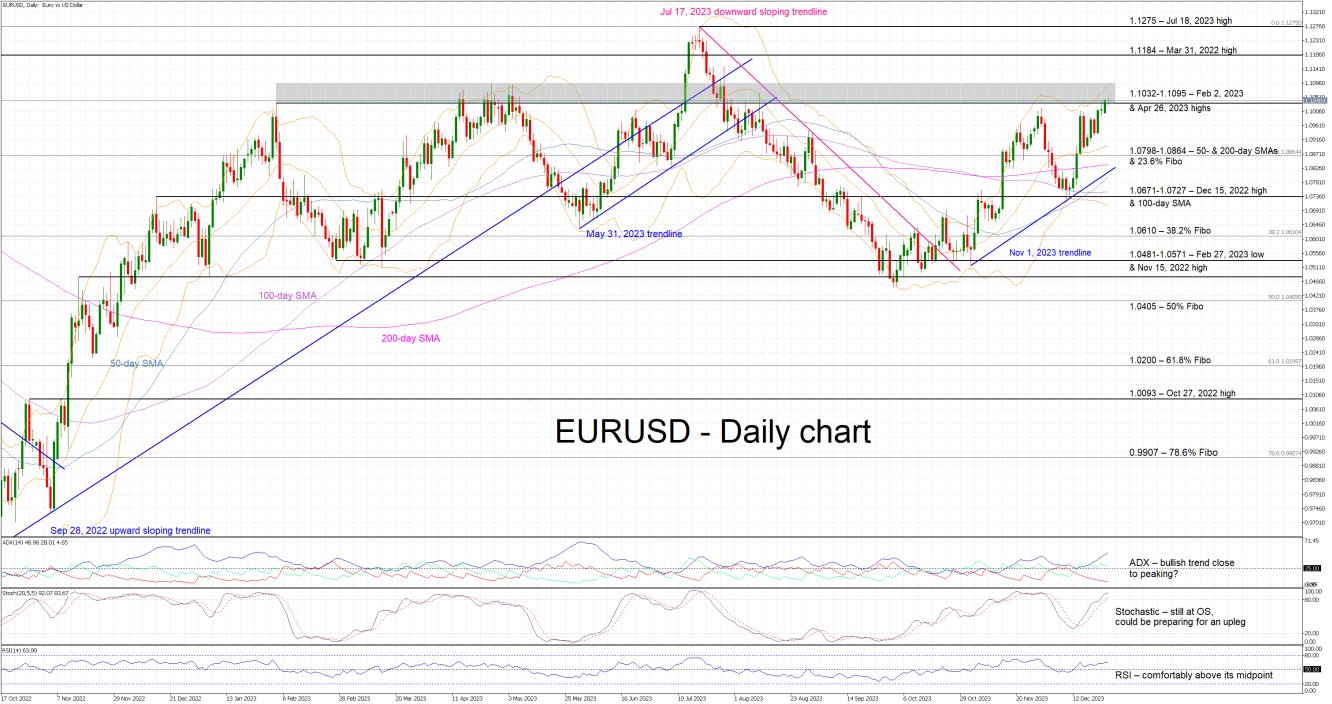

The EURUSD currency pair is encountering a crucial resistance level, which could determine the short-term direction of the market. As of today, February 5, 2025, the euro is testing significant technical barriers against the US dollar. The current price action suggests that any further movement will largely depend on how the market reacts to this resistance. A breakout above this level could pave the way for further upside, while a failure to break through might lead to a price retreat.

Market sentiment remains mixed, with both the euro and the US dollar under pressure from global economic factors. On the one hand, the eurozone has been showing signs of resilience despite facing economic headwinds. On the other hand, the US dollar has been supported by ongoing strength in the US economy, especially in light of recent economic data releases. This dynamic has created a tug-of-war for control of the EURUSD pair, resulting in a tight consolidation range.

For traders, watching this resistance level closely is critical. A push past this level could lead to a test of higher levels, particularly if key economic reports later this week suggest continued strength for the eurozone. Conversely, any negative surprise from the eurozone or a strengthening of the dollar could force the EURUSD back down.

As we look ahead, it is essential to keep an eye on any developments from central banks. The European Central Bank (ECB) and the Federal Reserve have both been active in shaping their monetary policies, and any shifts in their stance could add volatility to the pair.

Investors and traders should stay prepared for potential breakouts or pullbacks in the EURUSD as it faces this crucial resistance. As always, it’s important to approach the market with caution, keeping an eye on key technical levels and economic releases for more clarity.

Get the latest updates on Energy, Construction, Engineering, and Cryptocurrency. Join us on WhatsApp or Telegram for real-time news. Have a report or article? Send it to report@epci.ng. Follow us on X (Twitter), Instagram, LinkedIn, and Facebook for more industry insights.

Leave feedback about this