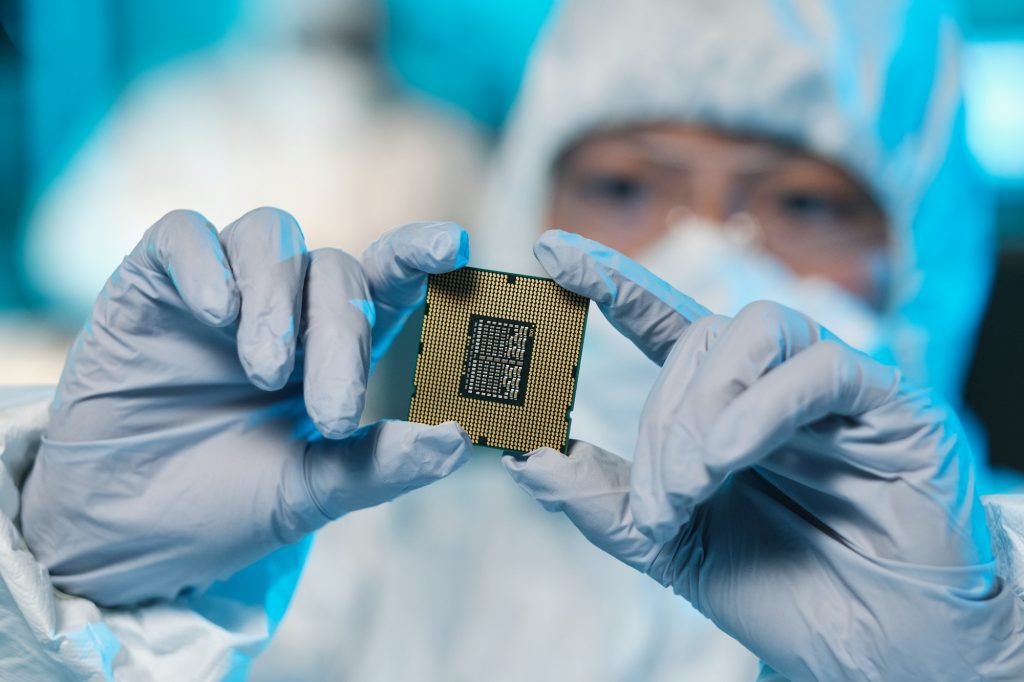

Taiwan’s semiconductor industry, long regarded as the global leader in chip manufacturing, is facing mounting pressure from rapidly advancing Chinese competitors. As China ramps up its investment in domestic chip production, Taiwanese firms, including industry giant TSMC, are navigating an increasingly challenging landscape marked by geopolitical tensions, supply chain shifts, and aggressive pricing strategies from mainland rivals.

China has significantly increased funding for its semiconductor sector, aiming to reduce reliance on foreign technology and achieve self-sufficiency in advanced chip manufacturing. Companies such as SMIC and Hua Hong Semiconductor are making notable progress, leveraging government subsidies, state-backed research, and partnerships to accelerate development. These efforts have begun to erode Taiwan’s dominance in certain segments of the semiconductor market.

Rising production costs and geopolitical uncertainty have further complicated matters for Taiwanese manufacturers. The U.S.-China tech war has forced Taiwan’s chipmakers to reassess supply chain strategies, with many investing in new fabrication plants outside Taiwan to mitigate risks. However, Chinese firms continue to gain ground, particularly in producing chips for consumer electronics, artificial intelligence, and automotive applications.

Industry experts warn that Taiwan’s semiconductor sector must continue innovating and expanding into new markets to maintain its competitive edge. While companies like TSMC still lead in cutting-edge chip technology, China’s rapid advancements and strategic government support signal a shift in the global semiconductor landscape. The coming years will be crucial in determining how Taiwan responds to the growing challenge posed by its mainland rivals.

Stay informed

Get the latest updates on Energy, Construction, Engineering, and Cryptocurrency. Join us on WhatsApp or Telegram for real-time news. Have a report or article? Send it to report@epci.ng. Follow us on X (Twitter), Instagram, LinkedIn, and Facebook for more industry insights.