Solar energy is becoming more popular as homeowners look to reduce electricity bills and lower their carbon footprint. Many homeowners ask, “Does homeowners insurance cover solar panels?” Protecting your solar investment is essential because these systems represent a significant financial commitment.

Most homeowners insurance policies automatically include rooftop solar panels as a permanent home improvement. However, coverage limits and exclusions can vary. Your policy may not cover ground-mounted systems, certain natural disasters, or damages exceeding your coverage limit.

This guide explains how your existing homeowners insurance may cover your solar panels, when premiums might increase, and when standalone insurance or warranties could help. By understanding your options, you can secure your solar system and avoid unexpected costs.

Do You Need Solar Panel Insurance? A Complete Homeowner’s Guide

Installing solar panels is one of the smartest ways to cut your electricity bills and reduce your carbon footprint. But solar systems are expensive and exposed to weather year-round. That’s why many homeowners ask: Do I need insurance for my solar panels, or does my homeowners insurance already cover them?

In this guide, we’ll break down what homeowners insurance usually covers, when you might need standalone solar insurance, and how warranties protect your investment.

Note: We are solar experts, not insurance professionals. Always check with your insurance agent for guidance specific to your policy.

Quick Overview of Solar Panel Insurance

-

Most homeowners insurance policies cover rooftop solar panels as part of dwelling coverage.

-

Adding solar panels can increase your home’s replacement value, which may slightly raise your insurance premiums.

-

Updating your policy could cost $15 a month or more, depending on your system and coverage limits.

-

Standalone solar insurance is usually unnecessary for rooftop installations but may help with ground-mounted systems or solar carports.

-

Solar panel warranties often cover risks beyond homeowners insurance, protecting your investment even further.

Does Homeowners Insurance Cover Solar Panels?

Yes. Most policies automatically cover rooftop panels because they count as a permanent home improvement. Fire, storm, or theft damage is usually included.

However, insurance has limits. Events like floods, earthquakes, or landslides often need separate coverage. If an uncovered event damages your panels, you pay for repairs.

Panels not on your roof, such as ground-mounted arrays or solar carports, may need extra coverage. These structures sometimes don’t qualify for standard dwelling coverage.

Will Solar Panels Raise Your Insurance Premiums?

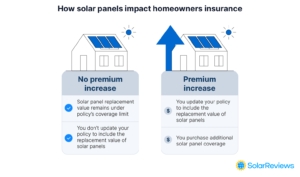

Adding solar panels can affect premiums if your home’s replacement value exceeds your policy limits.

-

No premium increase: If the replacement value stays under the coverage limit, your premium likely won’t change.

-

Premium increase: If solar panels push the replacement cost above your limit, updating your policy may raise your monthly premium. This could be as low as $15 or more if you buy a separate solar insurance policy.

Tip: If you don’t adjust your coverage, you could be underinsured. Damage may not be fully covered, leaving you to pay for repairs.

How Solar Panels Affect Replacement Value

Adding solar panels increases your home’s replacement cost. Sometimes, the increase stays under your coverage limit—no action needed.

If the new replacement value exceeds your policy limit, you risk being underinsured. Updating your coverage ensures both your home and solar system are fully protected.

Leased or PPA Solar Panels: If a solar company owns your panels, their insurance covers them. You don’t need extra coverage or worry about exclusions in your own policy.

Do You Need Standalone Solar Insurance?

Most rooftop systems don’t need a separate policy. Simply adjust your homeowners insurance to include your solar array. Updating your policy every few years is smart, since property values change over time.

You can also get third-party solar insurance. Companies like Solar Insure offer extra protection, often acting like extended warranties. Some even cover your panels if your solar provider goes out of business.

When Standalone Solar Insurance Makes Sense

Consider supplemental insurance if:

-

Your system is expensive: The average U.S. solar system costs about $21,800. Larger systems with batteries may cost more. Standalone insurance can be cheaper than raising your homeowners coverage.

-

You install ground-mounted panels or carports: These structures often fall under auxiliary dwelling coverage, which is lower than your main home coverage.

-

Your installer offers limited warranties: Standalone policies can cover poor workmanship, equipment failure, or underperformance that homeowners insurance might not.

Understanding Solar Warranties

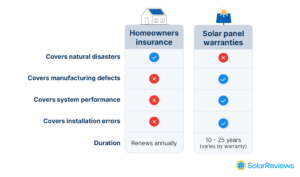

Warranties protect your solar system alongside homeowners insurance:

-

Equipment warranty: Covers manufacturer defects in panels, inverters, batteries, and other components. Typical coverage lasts 25–30 years, with some manufacturers offering up to 40 years.

-

Production warranty: Guarantees your system maintains 85–92% of its starting wattage over 25 years. Some last up to 40 years.

-

Workmanship warranty: Ensures installers don’t make errors that cause premature failure. Coverage typically lasts 5–40 years.

These warranties give peace of mind, even if homeowners insurance doesn’t fully replace your system.

Roof Damage After Solar Panel Installation

Homeowners insurance usually doesn’t cover poor workmanship. Roof leaks after installation may fall under your installer’s warranty instead. Always:

-

Review your installer’s warranty carefully

-

Document damage

-

Contact your installer promptly

Choosing a reputable installer with a roof leak warranty ensures your system is installed properly and minimizes future problems.

Solar panels are a valuable investment. Most homeowners insurance covers rooftop systems, but you should review coverage limits and consider warranties or standalone insurance when needed. By understanding your options and choosing a trusted installer, you can protect your investment and enjoy clean energy for decades.

Conclusion: Does Homeowners Insurance Cover Solar Panels?

Homeowners insurance generally covers rooftop solar panels as part of your dwelling protection. However, coverage depends on your policy limits, local regulations, and the type of solar system you install. Ground-mounted systems, carports, or high-value setups may require additional or standalone coverage.

Updating your policy to include the full replacement value of your solar panels can prevent gaps in protection. Standalone solar insurance can offer extra security, especially if your system is expensive or your installer provides limited warranties.

Remember, solar equipment warranties cover manufacturer defects, production performance, and installation workmanship, providing added protection beyond insurance. Choosing a reputable installer and maintaining your system ensures long-term reliability.

By understanding your homeowners insurance and solar warranties, you can protect your investment, avoid unexpected costs, and confidently enjoy the savings and environmental benefits of solar energy.